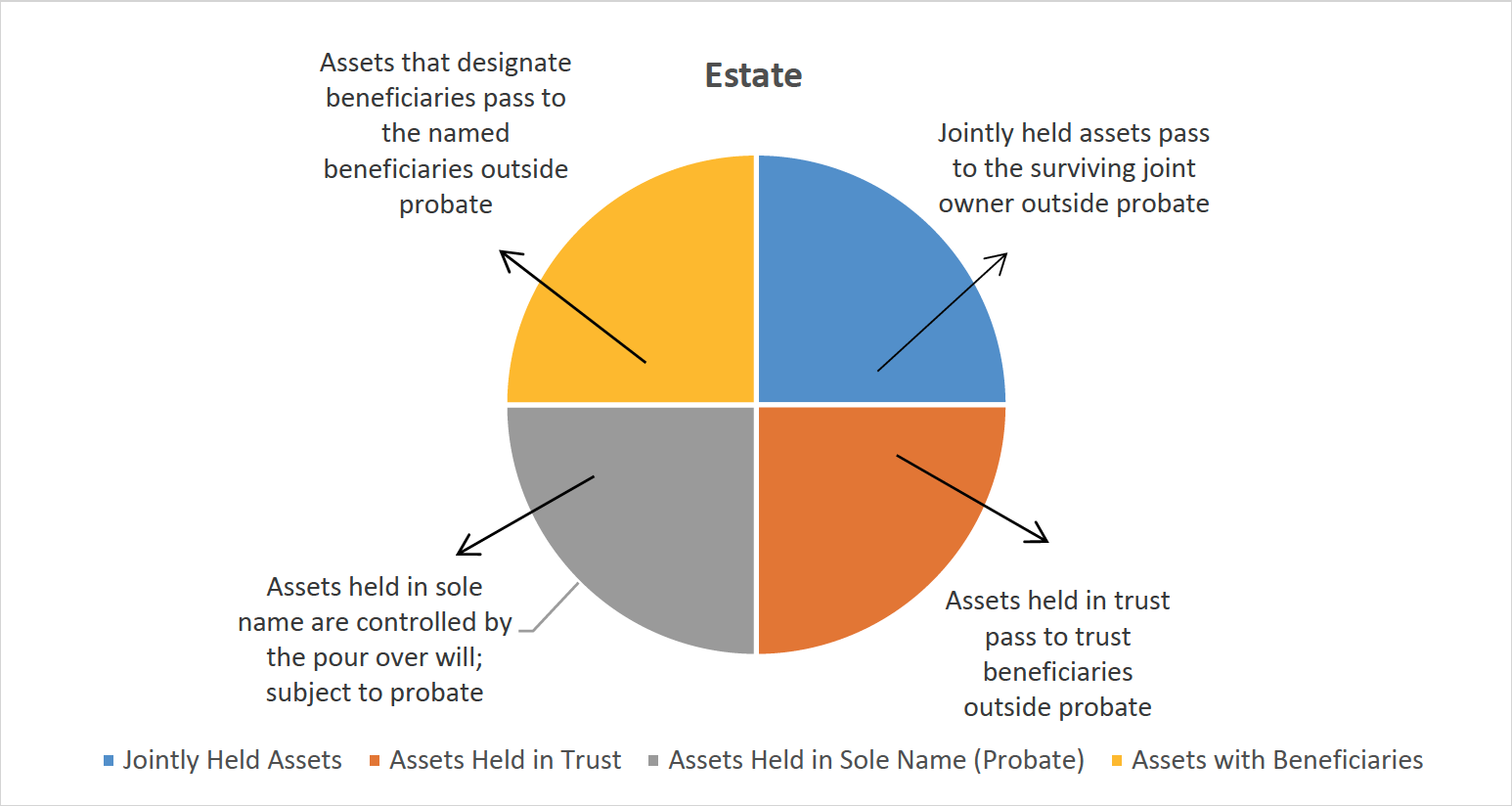

- Remember – your Will and Trust do not control assets that designate a beneficiary or that are owned jointly, with rights of survivorship, with another person.

- Make sure your beneficiary designations are up-to-date and consistent with your estate planning objectives. Don’t name a person as beneficiary unless you want them to become the owner of the property at your death.

- Don’t title assets jointly with another person unless all of the following are true:

- You want the joint owner to own the property at your death; and

- You are willing to put the property at risk for the joint owner’s liabilities.

- Don’t forget to fund your trust!

- If you are married, take advantage of the concept of “portability” to reduce federal estate tax liability. The concept of portability works like this: If the first-to-die spouse does not use his or her entire estate tax exemption, any unused portion is preserved for the surviving spouse. When the surviving spouse dies, the surviving spouse may use his or her own estate tax exemption plus any unused exemption attributable to the first-to-die spouse. In order to take advantage of portability, a federal estate tax return must be filed timely when the first spouse dies, even if no estate tax is due and payable, because this filing determines unused exemption amount that will be available to the surviving spouse.

- If you have disabled beneficiary, consider having a special needs trust in place for him or her.

- Make sure you have a financial power of attorney and a health care power of attorney. In most cases, these will ensure the court does not have to get involved in your life if you become incompetent.

- Remember – you don’t control what happens to your body after you die. Take steps to ensure your wishes are upheld.

- Michigan Public Act 57 of 2016, effective June 27, 2016, permits you to name a “funeral representative” to make funeral arrangements and decisions about the disposition of your body (prior to the effective date of this act, these decisions rested with your surviving spouse or, if none, next of kin). This designation must be in a “written instrument” that is signed in the presence of two witnesses and a notary. It may be included in your Will or your durable power of attorney for health care.

- Make sure the fiduciaries you name are well-suited to carry out their responsibilities.

- When considering the disposition of your estate, consider a charitable gift to benefit those less fortunate. You don’t have to give a lot to make a difference. What if we all left gave 5% to charity? A few years back, a study in Eaton, Ingham, and Clinton Counties showed this would result in $879,000,000 in charitable gifts for Eaton, Ingham and Clinton Counties over the next 25 years. Think of that!

- (517) 853-6900

- 271 Woodland Pass, Suite 115, East Lansing, MI 48823

- Online Payments